New auditor for Hyattsville

City treasurer says that current auditor "felt that it was not in his best interest to continue to provide that service to the city"

At last night’s city council meeting, Hyattsville city administrator Tracey Douglas announced that the city had selected Zelenkofske Axelrod LLC to audit fiscal years 2024, 2025, and 2026. The new audit firm is based out of Pennsylvania with an office in Annapolis and was the sole respondent to the city’s request for proposals, according to staff.

The current auditor, Lindsey + Associates, will finish the FY 2023 audit, due October 31, 2023 and not yet available on the city’s website. Lindsey + Associates was also contracted to complete the city’s FY 2021, 2022, and 2023 federal single audits, which have not yet appeared on Federal Audit Clearinghouse. Lindsey + Associates declined to bid to renew their contract with the city, according to city treasurer Ronald Brooks at the January 13, 2025 city council meeting. Brooks reported that Lindsey + Associates’ president Robert Diss felt that “he was at a disadvantage as to some of the questions being posed towards him relative to the audit,” during his last presentation to the city council and “felt there was a gotcha type of scenario coming from the legislative body.” Brooks went on to say that accounting firm owners “have to safeguard [their] CPA certifications and so he felt that it was not in his best interest to continue to provide that service to the city.”

The new audit firm will also be responsible for preparing the city’s annual financial statements as well as auditing them to ensure they are correct, according to procurement documents.

The council also approved a new audit committee, sponsored by Councilmember Emily Strab (Ward 2) with Mayor Robert Croslin, Councilmember Danny Schaible (Ward 2), and Councilmember Kareem Redmond (Ward 3) co-sponsoring. During discussion, Councilmember Joanne Waszczak (Ward 1) said that she was “somewhat concerned about the potential for a city committee that focuses on audits have some kind of unintended chilling effect on the auditor or on the audits themselves” and that “this is not a game of gotcha, this is a game of let’s keep getting better at this.” Waszczak went on to say that the council and staff “would have to be very mindful” when setting up the new committee after approval and “very specifically prevent them from over-interpreting their role and trying to exert unhelpful influence and trying to interfere in the audit process.”

To recap: Hyattsville keeps ongoing financial records — records like how much money the city currently has, how much it has collected and spent, and how much money it is still obligated to pay out in the future, either to creditors or pensioners. Every year, the city is supposed to collect that information into the annual comprehensive financial report — the financial statements — and an independent, unbiased auditor is supposed to come in and “obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error.” As part of those financial statements, the city also reports whether or not it complied with its council-authorized budget that year, such as when it disclosed that it overspent its capital projects budget by $2.2 million in FY 2021.1

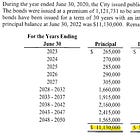

Once the auditor has, in their opinion, examined enough evidence to be reasonably sure the city’s financial statements are correct, they issue an opinion letter saying so. That opinion letter, together with the financial report, is sent to the state, published for the public, and also provided to the city’s creditors. The state of Maryland requires Hyattsville to complete an annual financial statement audit, and the city of Hyattsville itself has also promised creditors that it will provide annual audited financial statements. Finally, because Hyattsville has been spending more than $750,0002 of federal money for the past several years, the federal government also requires a Single Audit (formerly known as an A-133 Audit) to account for where federal funds have gone and whether the city has complied with federal grant terms.

Anyone looking at the financial statement is supposed to be able to assume that it is accurate — that’s the whole point of hiring an auditor.

Hyattsville spent without council approval

The city of Hyattsville spent money without city council approval and exceeded authorized contract maximums in fiscal year 2022, according to a review of accounts payable data obtained via Public Information Act request. This includes almost $400,000 from recurring monthly Dataprise invoices and almost $60,000 to a Baltimore-based real estate developmen…

Page 72; though since Hyattsville is late on its audits the overspending wasn’t disclosed to the public until over 2 years after the end of FY 2021

The cut-off rose to $1 million in October 2024

I'm very curious about this part: 'Brooks went on to say that accounting firm owners “have to safeguard [their] CPA certifications and so he felt that it was not in his best interest to continue to provide that service to the city.”'

Why would providing auditing services put an auditor's CPA certification at risk? (Suppose you read that Aldi was worried about safeguarding its grocery license and therefore wasn't going to sell food anymore. Wouldn't you scratch your head at that?)

I can think of a explanation, but it's not very pretty. I'm hoping someone else can offer an explanation that doesn't make anyone look bad.

Thoughts?