Hyattsville releases FY 2025 budget

Expenditures exceed expected revenues by $4.9 million, a situation sometimes called an "operating deficit"

Hyattsville’s 2025 budget document proposes $27.5 million in revenue and $32.3 million in expenditures and transfers, a $4.9 million excess of expenditures over revenues. According to the document, the city expects to begin fiscal year 2025 with $21.1 million in the general fund. Compared to the current budget, the city projects an 11.8% increase in revenues and a 7.7% increase in expenditures and plans to hold the real property tax rate steady at 63 cents per $100 of assessed value. Real property tax generates approximately two-thirds of the city’s revenue.

Expenditures

Hyattsville’s charter requires the city to pass a budget where expenditures do not exceed the sum of revenues and carry-forward balances from prior year surpluses. Though the new budget proposes expenditures in excess of new revenues, Hyattsville will use leftover general funds saved by the city to meet the charter requirements. Some other governments refer to the situation where yearly expenditures exceed yearly revenues as an “operating deficit.” The term “deficit” has been controversial in Hyattsville city council meetings.

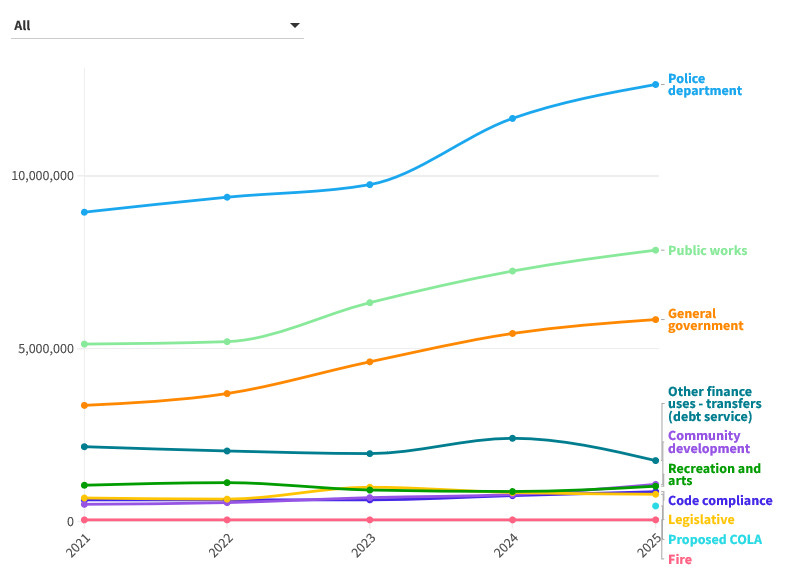

As in previous years, Hyattsville’s largest general fund department expense is the police department, which has $12.6 million of proposed expenditures, an 8.4% increase over FY 2024. Across all departments, Hyattsville spends two-thirds of its expenditures on staffing costs, a proposed $21.4 million for FY 2025 on wages, overtime, fringe benefits, and a proposed cost-of-living adjustment, a 4.9% increase in staffing-related budgets from FY 2024. According to the budget proposal, the city added 20 new staff roles in FY 2023 and FY 2024 and is requesting six new positions for FY 2025.

Compared to the FY 2021 budget five years ago, the largest increase by department is in community development, which has more than doubled its budget in this proposal. Expected FY 2025 revenues are 33% higher than budgeted FY 2021 revenues. Five departments — community development, general government, public works, police, and code compliance — have five-year budget increases greater than 33%.

The FY 2025 budget proposal reports actual spending for FY 2021 through FY 2023, and then budget and partial-year amounts for FY 2024, the current fiscal year. Due to intradepartmental reorganizations, apples-to-apples comparisons with prior budget books are difficult, but the FY 2025 budget document allows readers to compare proposed FY 2025 expenditures with actual expenditures from FY 2021 on a sub-department level. Seven sub-categories have more than doubled since FY 2021: call-a-bus (251% increase), police special services (210%), public works administration (158%), mayor (131%), community development (127%), recreation/teen center (123%) and human resources (100%).

The final budget ordinance will present budgets for all four funds — general, special revenue, capital projects, and debt service — as in previous years. Though the bulk of the budget document is focused on the general fund, the city is also request $13.5 million in capital projects funding for FY 2025. The capital projects section does not detail prior year spending, but the recently reissued FY 2021 audit revealed that the city exceeded its FY 2021 capital projects budget by approximately $2 million.

Revenues and comparisons

Hyattsville has gotten more affluent in recent years, with rising income and property wealth. From 2020 to 2022, the most recent available data, Hyattsville’s average taxable income per tax return grew 19.5% from $42,740 to $51,094, according to state records. The assessable real property tax base grew 33% between FY 2021 and estimated FY 2025, from $2.2 billion to $2.9 billion.

The graph above display Hyattsville’s expenditures, assessable base, revenues, consumer price index (urban), Case-Shiller index (DC) and average net taxable income all indexed to the beginning of 2020.1 Expenditures have the highest growth rate since 2020, followed by the assessable base and revenues. All three indicators exceed the consumer price index, a standard measure of inflation.

Because Hyattsville derives more than two-thirds of its revenue from property and income taxes, rising income and wealth will result in rising revenues if tax rates stay constant. Hyattsville’s average income growth2 exceeded inflation for the years where data is available. The assessable base, which is the total assessment valuation of land and buildings in Hyattsville, exceeded inflation but has stayed at or below the Case-Shiller Index3 for the DC metro area, indicating that Hyattsville home prices may not be rising as quickly as home prices in the region as a whole.

Maryland has only released local income data through tax year 2022; all values except net taxable income are indexed to the beginning of Hyattsville’s fiscal year. Net taxable income is indexed on a calendar year basis.

Net taxable income divided by the number of returns

S&P Dow Jones Indices LLC, S&P CoreLogic Case-Shiller DC-Washington Home Price Index [WDXRSA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WDXRSA, April 26, 2024. As of publication, values are available through the end of 2023.