Hyattsville reissues 2021 financial statements

The city of Hyattsville recently reissued its financial statements for the fiscal year ending June 30, 2021. The independent auditor’s report, signed by Lindsey + Associates, is dated April 11, 2024 with “reissue” below the date. The report was reissued approximately 2 years and 5 months after the state deadline of October 31, 2020.

The independent auditor’s report does not explain what was changed, why the statements were reissued, or inform readers whether the prior financial statements (issued February 2024) are still reliable.1 Auditing guidelines require that reissued auditor reports “include an emphasis-of-matter paragraph in the auditor’s report when there are adjustments to correct a material misstatement in previously issued financial statements.”

Hyattsville’s 2021 finances

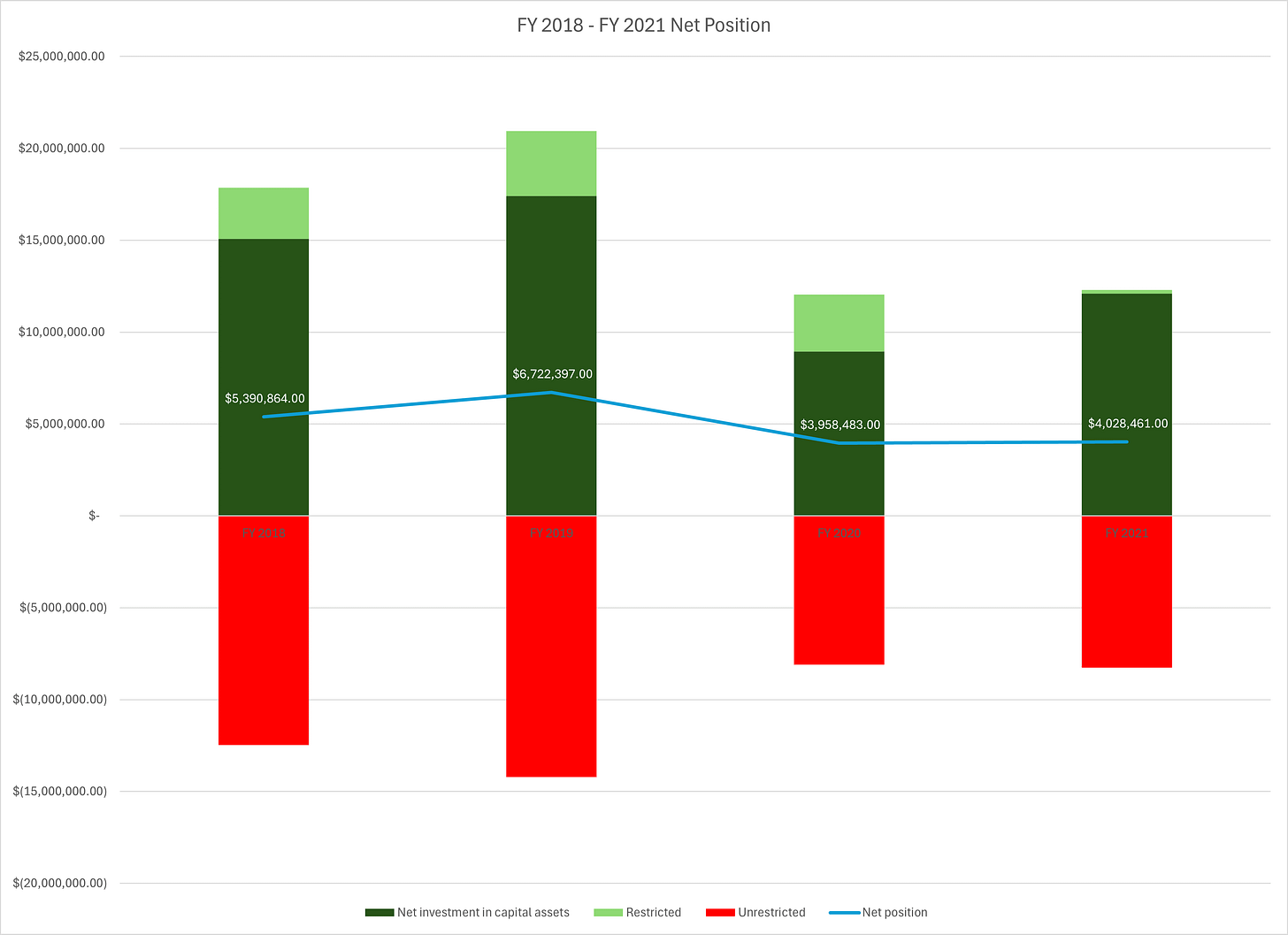

The city reported a net position, the government equivalent of net worth, of $4,028,461, a small increase from FY 2020. The city’s net investment in capital assets, which is the value of the city’s long-term property such as buildings and vehicles minus associated debt, is $12.1 million, while the unrestricted portion of net position is negative $8.3 million, a deficit. According to the management discussion and analysis, a required narrative portion of the financial statements, the city’s deficit unrestricted net position is due to liabilities for retiree insurance benefits (called other post-employment benefits, or OPEB for short) and pensions. The document also states that “management is working towards decreasing the deficit for FY 2022 by increasing revenues and controlling expenses.”

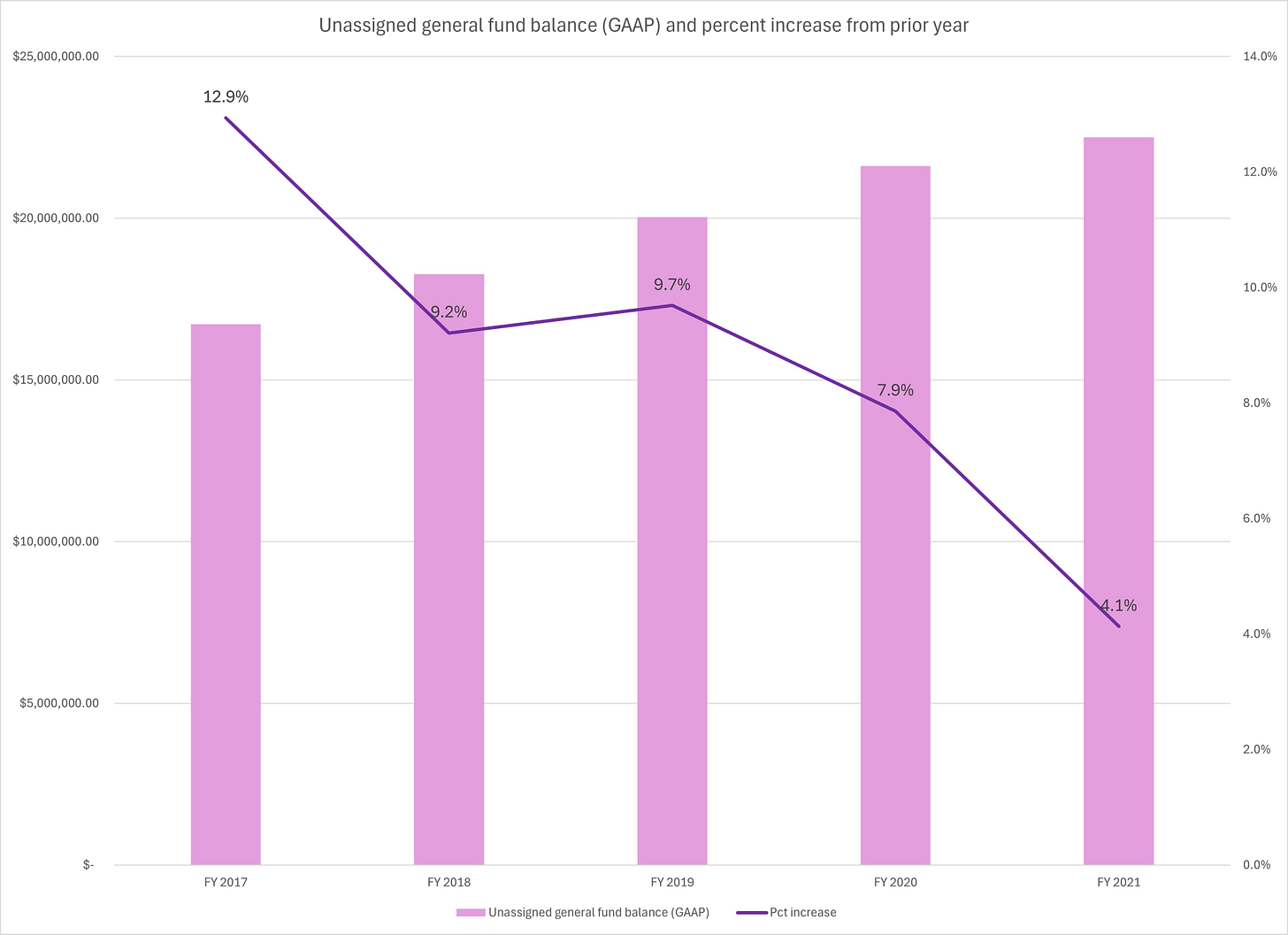

The city reported an unassigned general fund balance of $22,506,746, an increase from FY 2020. This amount is reported on a modified accrual basis in accordance with generally accepted accounting principles (GAAP) for local governments, and differs slightly from the general fund balance on a budgetary basis, which is reported later in the document.

Differences between the modified accrual (GAAP) basis and budgetary basis are common due to varying accounting rules between the two methods. For example, funds that are encumbered during one period are often considered spent on a budgetary basis but not on a modified accrual basis. If a city issued a purchase order for $10,000 worth of stop signs two days before the end of its fiscal year, it would typically report $0 worth of stop sign expenditures on a modified accrual basis, but $10,000 on a budget basis. Because financial statement readers often want to know whether a city has complied with its budget, government accounting guidelines require that local governments present revenues and expenses under both methods.

On the modified accrual basis used in the basic financial statements, the city reported a total of $24 million in revenues across the four major funds (general, special revenue, capital projects, and debt service) and $26.5 million in expenditures, as well as $331,312 in net revenue from other financing, for a yearly decrease of approximately $2.1 million across all four fund balances.

The city reported $17.5 million of long-term debt, $26.3 million of OPEB liabilities, and $11.9 million of pension liabilities at the end of FY 2021. The largest change was in OPEB liabilities, which grew by $3.8 million from $22.5 million at the end of FY 2020. According to the document, Hyattsville “has elected not to fund this obligation…contributions continue on a pay-as-you-go basis, and the future payment of these benefits is contingent upon the annual approval of the operating budget by the City Council.”

Hyattsville’s general fund budgetary compliance

The general fund budgetary comparison schedule shows no modifications between the original and final budget amounts. At one point, the document reads “the original budget was amended twelve times during the year,” while on another page it states “The originally adopted fiscal year 2021 budget was not amended during the year.” In an email to Route One Finance, city treasurer Ronald Brooks said the original FY 2021 budget was amended twelve times.

According to the reissued financial statements, the city exceeded its budgeted revenue by $791,137 and underspent its approved expenditures by $2.4 million. Recreation and community development both report budget overages of $597,223 and $58,021 respectively. The budgetary basis general fund balance increased $3.1 million from the beginning of the year, ending at $23.3 million. The previously issued FY 2021 financials reported that the same fund balance at the end of FY 2021 was $17.1 million.

From FY 2017 to FY 2021, Hyattsville exceeded its budgeted revenues and underspent its budgeted expenditures, spending an average 91% of the approved expenditure amount. As reported in the audits, the budgetary basis general fund balance has grown from $15 million at the beginning of FY 2017 to $23.3 million at the end of FY 2021. The additional revenue collected in FY 2021 was primarily from higher real property tax, personal property tax, and income tax revenue than initially expected.

In the capital projects fund budgetary comparison, the city reported exceeding final budgeted expenditures by $2 million. The overspending was primarily in public works, which spent $8.4 million and had a $6 million budget. This excess was partially offset by lower-than-budgeted capital expenditures in other departments, primarily community development.

Limited changes from subsequent draft

Route One Finance has compared the newly released financial statements with both the February 2024 audited financial statements and found the following changes, which were also detailed in the previous article comparing the original document to a subsequent draft document posted to the city’s website earlier this month:

Fire department expenditures were changed from $923,065 to $50,000, a 95% decrease with respect to the original amount.

The city’s net position changed from $3.2 million to $4 million, a 28% increase with respect to the original amount.

A paragraph representing that the city evaluated subsequent events through February 19, 2024 was entirely deleted.

The beginning budgetary basis general fund balance in the required supplementary information was changed from $16,727,643 to $21,964,310. The original beginning fund balance of $16.7 million in the report issued in February 2024 was inconsistent with the $21,967,271 ending fund balance reported in the same schedule in the FY 2020 financial statements (issued in June 2023).

As noted earlier in the article, the FY 2021 ending budgetary basis general fund balance was changed from $17,141,909 to $23,251,641, a 36% increase with respect to the original amount.

Route One Finance also compared the newly released financial statements to the subsequent draft document and found that the only changes were in the independent auditor’s report:

The independent auditor’s report is now signed.

The date of the independent auditor’s report was changed to April 11, 2024 from February 19, 2024.

“Reissued” was added below the date.

April 27, 2024: I changed a section heading from “Hyattsville’s budgetary compliance” to “Hyattsville’s general fund budgetary compliance” to make it more clear that the section only discusses the general fund budget versus actuals.