$17 million deficit for Hyattsville's capital fund after years of high spending, little revenue

Hyattsville's general fund balance is only part of the financial picture; city's FY 2025 budget proposal does not disclose capital project spending from prior years

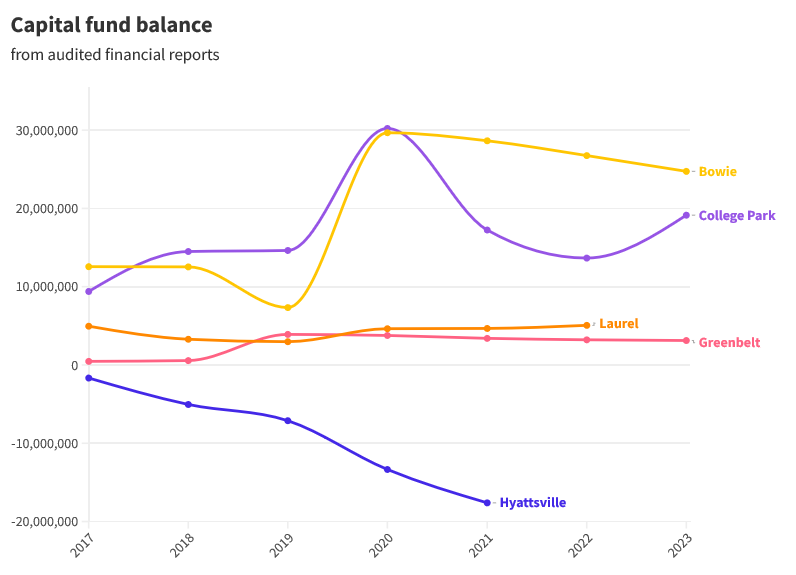

Hyattsville’s capital project fund is $17 million in the red as of the end of fiscal year 2021. Since FY 2017, the city has spent millions on large projects, while not issuing the debt meant to fund the spending, according to the last three available audits and a review of publicly available municipal debt information. Meanwhile, other municipalities have kept a positive capital fund balance — “in the black” — by offsetting capital spending with tax revenue and new debt in the form of municipal bonds. The city proposes to spend $41.8 million on capital projects over the next 5 years, including $13.5 million in FY 2025.

Without concrete numbers, either through audited financial statements or unaudited budget presentations, city residents have no idea how much the city has spent on capital projects in the past few years. Previous budget ordinances do not disclose the capital projects fund balance, so the public only learns about the deficits years later when audits are finally released. Additionally, the city’s auditors have said for multiple years that the city may not be producing reliable financial information between audits because of serious problems in its accounting process.

Hyattsville uses its general fund to pay for its day-to-day operating expenses, such as salaries, consultants, and electric bills. Most general fund money comes from taxes. But for larger, long-term spending like buying vehicles or renovating the new police headquarters in Ward 5, the city uses the capital projects fund . Local governments can fund capital project expenditures with normal tax revenue by transferring money from the general fund to the capital fund or they can raise money by taking on debt, as Hyattsville did in FY 2020 and FY 2023.

In each of the past six budget years, Hyattsville city council has passed a budget that relied on bond proceeds to provide revenue for the capital projects fund, but the city has usually failed to issue those bonds according to annual financial reports and public disclosures. From fiscal year 2019 to 2021, Hyattsville planned to issue $29.5 million in new debt to fund $26 million in capital spending, but actually received only $13.6 million from new debt while spending $23 million over the three years.

Until the city can issue new debt to make up for the deficit, it is essentially loaning money to the capital projects fund from other funds to pay for capital spending, on top of budgeting year-to-year operating deficits in the general fund. The city obtained a credit rating for its 2019 bond issue, but subsequently lost that credit rating due to its persistently late audits. Moody’s revoked the city’s credit rating in August 2022 after the city could not produce audited financials for FY 2020, which ended June 30, 2020.

While the city has not released audited figures for FY 2022 and 2023, and did not provide unaudited numbers by press time, the original budgets called for a total of $26.5 million in bond revenue and $25 million in capital spending. Hyattsville only issued $11 million of new debt in FY 2023, according to municipal bond disclosures.

For FY 2024, the city planned to take out $18.9 million of new debt, but has not yet issued any new bonds or bond anticipation notes (BANs), a form of short-term debt that is usually refinanced into a regular municipal bond. The city told the state treasurer that it intended to issue $25 million of “public competitive” debt for the purpose of “refunding” in April 2024. No such debt appears to have been issued. The city did not respond to questions about whether it intends to still issue this debt by press time. FY 2024 ends June 30, 2024.

Hyattsville last had a positive capital projects fund balance at the end of FY 2016, and authorized work to begin on the new police headquarters in FY 2017, projecting costs of $10 million according to the Hyattsville Life & Times. Since then, estimated project costs more than doubled while interest rates soared. It’s now more expensive for Hyattsville to borrow money for capital projects than it was in 2017 when the city began racking up capital project deficits that they need to cover with either new debt or transfers from the general fund. Hyattsville has covered some capital spending with federal money from the American Rescue Plan Act (ARPA), such as renovations to city council chambers in city hall.

Though the city did issue bonds for the new police headquarters and a public works renovation project in FY 2020, the bond proceeds were reported as debt service fund income in the FY 2020 audited basic financial statements. This is a departure from the city’s previous practice of reporting that income as capital projects fund income, as it did with its last general obligation bond issue in FY 2013.1 The city’s budget basis capital fund balance is inconsistent between the FY 2020 and FY 2021 financial reports. The city reported it had a budget basis capital fund balance of -$11 million on June 30, 2020 in the FY 2020 report.2 However, it reported the same balance was $0 on July 1, 2020 in the FY 2021 report.3 Route One Finance has previously covered budget basis fund discrepancies between the FY 2020 and FY 2021 audit.4

How does the capital projects fund work?

Think of the city’s spending as similar to a households. Let’s say you want to put solar panels on your roof. You might use savings to pay for them (akin to a transfer from the general fund to the capital projects fund) or you might take out a solar panel loan (financing, much like the city issuing new bonds). If you get the loan before the solar panel bill is due, you can use the money from the loan to pay for the solar panels. But if you don’t get the loan money before you need to pay for the panels, you’ll have to pay for them out of whatever cash you have on hand.

Since FY 2007, city budgets have always included new bond money in the capital projects budget, but rarely followed through on issuing the debt. Over the past ten completed fiscal years (FY 2014 to FY 2023), Hyattsville budgeted to issue over $100 million in new debt, while actually completing only two new debt issuances totaling $23.7 million.5

While the city has not released figures for more recent years, the city exceeded its budgeted expenditures in both FY 2020 and FY 2021, according to the audited financial reports. Neighboring College Park presents actual capital project spending for FY 2022 and FY 2023, as well as budget and estimated spending for the current fiscal year, in its FY 2025 budget. College Park’s budget document also shows its intended capital projects revenue sources — where the city plans to get the money for its capital projects — for FY 2025. Hyattsville’s FY 2025 budget proposal does not display this information.

All of Hyattsville’s net worth — called “net position” — for governments is in its capital assets. The city’s net investment in capital assets — the worth of its property and equipment like the city building on Gallatin Street and police vehicles, minus debt associated with that property — has been at least twice its unrestricted net assets during the past five audits. This means the city does not have enough unrestricted cash on hand to cover all its liabilities, which include long-term liabilities like pensions and retiree health benefits that aren’t due immediately. This is out of step with other large municipalities in Prince George’s County, most of which have cash or other, more easily sellable, assets equal to or exceeding what they owe to employees, creditors, and other entities. It’s common for cities to have a large part of their net worth in capital assets, just like a large part of a homeowner’s net worth is often her home equity.

As well as the bond issues in FY 2008, 2010, and 2011

Page 53

Page 69

Based on other numbers in the report, I estimate that the true capital projects FY 2021 ending balance is about -$23 million on a budget basis, but this is only an estimate. I calculated this figure by taking the GAAP basis ending fund balance found on page 22 and subtracting the net encumbrance adjustment on page 71.

$12,675,000 of general obligation bonds in FY 2020 (calendar year 2019) and $11,000,000 in “privately placed” bond anticipation notes (BANs) in FY 2023 (calendar year 2022), which were renewed at a higher interest rate in FY 2024 (calendar year 2023).